Property Tax Rate Llano County . updated property tax information now available for texas taxpayers; This notice provides information about two tax rates used in. this notice concerns the 2021 property tax rates for llano county. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based on a median home value of. notice of 2019 tax year proposed property tax rate. welcome to the website of the llano county tax office. llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. Within this site you will find general information about the district and the ad valorem property tax.

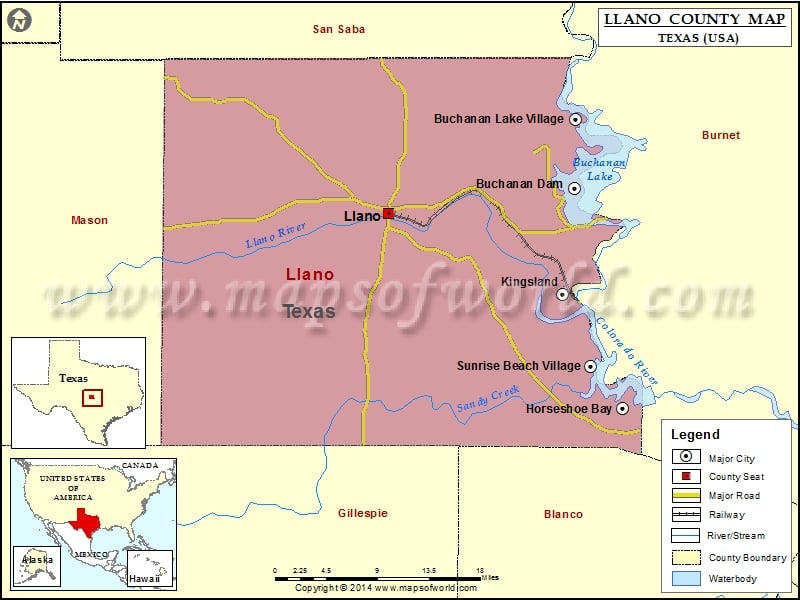

from www.mapsofworld.com

updated property tax information now available for texas taxpayers; this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. This notice provides information about two tax rates used in. the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based on a median home value of. notice of 2019 tax year proposed property tax rate. this notice concerns the 2021 property tax rates for llano county. llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. Within this site you will find general information about the district and the ad valorem property tax. welcome to the website of the llano county tax office.

Llano County Map Map of Llano County, Texas

Property Tax Rate Llano County the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based on a median home value of. This notice provides information about two tax rates used in. the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based on a median home value of. this notice concerns the 2021 property tax rates for llano county. llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. notice of 2019 tax year proposed property tax rate. welcome to the website of the llano county tax office. updated property tax information now available for texas taxpayers; Within this site you will find general information about the district and the ad valorem property tax.

From www.pdffiller.com

Fillable Online Special District Property Tax Rates in Llano County Fax Property Tax Rate Llano County Within this site you will find general information about the district and the ad valorem property tax. llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. This notice provides information about two tax rates used in. updated property tax information now available for texas taxpayers; . Property Tax Rate Llano County.

From pastureandpearl.com

Cook County Property Tax Rates April 2024 Property Tax Rate Llano County the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based on a median home value of. welcome to the website of the llano county tax office. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. this notice concerns. Property Tax Rate Llano County.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Property Tax Rate Llano County This notice provides information about two tax rates used in. the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based on a median home value of. this notice concerns the 2021 property tax rates for llano county. welcome to the website of the llano county tax office. this. Property Tax Rate Llano County.

From knowyourtaxes.org

Llano County » Know Your Taxes Property Tax Rate Llano County This notice provides information about two tax rates used in. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. this notice concerns the 2021 property tax rates for llano county. llano central appraisal district is a political subdivision of the state of texas that is responsible for. Property Tax Rate Llano County.

From mavink.com

Texas County Tax Rates Map Property Tax Rate Llano County Within this site you will find general information about the district and the ad valorem property tax. This notice provides information about two tax rates used in. notice of 2019 tax year proposed property tax rate. welcome to the website of the llano county tax office. updated property tax information now available for texas taxpayers; llano. Property Tax Rate Llano County.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate Llano County welcome to the website of the llano county tax office. This notice provides information about two tax rates used in. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based. Property Tax Rate Llano County.

From www.pennlive.com

Where are the highest property tax rates in central Pa.? Property Tax Rate Llano County this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. updated property tax information now available for texas taxpayers; Within this site you will find general information about the district and the ad valorem property tax. welcome to the website of the llano county tax office. this. Property Tax Rate Llano County.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate Llano County llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. the median property tax (also known as real estate tax) in llano county is $1,496.00 per year,. Property Tax Rate Llano County.

From dxoktsiec.blob.core.windows.net

How Much Can Property Taxes Increase Per Year In California at Natalie Property Tax Rate Llano County Within this site you will find general information about the district and the ad valorem property tax. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. welcome to the website of the llano county tax office. this notice concerns the 2021 property tax rates for llano county.. Property Tax Rate Llano County.

From www.mapsofworld.com

Llano County Map Map of Llano County, Texas Property Tax Rate Llano County Within this site you will find general information about the district and the ad valorem property tax. notice of 2019 tax year proposed property tax rate. llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. updated property tax information now available for texas taxpayers; This. Property Tax Rate Llano County.

From texascountygisdata.com

Llano County KMZ and Property Data Texas County GIS Data Property Tax Rate Llano County llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. this notice concerns the 2021 property tax rates for llano county. Within this site you will find general information about the district and the ad valorem property tax. This notice provides information about two tax rates used. Property Tax Rate Llano County.

From 101highlandlakes.com

Find property and tax information with and Llano county central Property Tax Rate Llano County updated property tax information now available for texas taxpayers; this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. notice of 2019 tax year proposed property tax rate. welcome to the website of the llano county tax office. Within this site you will find general information about. Property Tax Rate Llano County.

From www.attomdata.com

Property Taxes on SingleFamily Homes Rise Across U.S. in 2021 ATTOM Property Tax Rate Llano County updated property tax information now available for texas taxpayers; notice of 2019 tax year proposed property tax rate. llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. this property tax information is current and covers a wide range of topics, such as taxpayer remedies,. Property Tax Rate Llano County.

From www.dailytrib.com

Llano County to use reserves to keep tax rate low Property Tax Rate Llano County welcome to the website of the llano county tax office. updated property tax information now available for texas taxpayers; this notice concerns the 2021 property tax rates for llano county. this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. the median property tax (also known. Property Tax Rate Llano County.

From www.dailytrib.com

Llano County approves lean budget and low tax rate for FY25 Property Tax Rate Llano County this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. notice of 2019 tax year proposed property tax rate. Within this site you will find general information about the district and the ad valorem property tax. this notice concerns the 2021 property tax rates for llano county. . Property Tax Rate Llano County.

From texascountygisdata.com

Llano County Shapefile and Property Data Texas County GIS Data Property Tax Rate Llano County updated property tax information now available for texas taxpayers; the median property tax (also known as real estate tax) in llano county is $1,496.00 per year, based on a median home value of. This notice provides information about two tax rates used in. notice of 2019 tax year proposed property tax rate. llano central appraisal district. Property Tax Rate Llano County.

From www.dailytrib.com

Llano tax rate and budget move closer to adoption; new alderwoman sworn Property Tax Rate Llano County notice of 2019 tax year proposed property tax rate. updated property tax information now available for texas taxpayers; this property tax information is current and covers a wide range of topics, such as taxpayer remedies, exemptions and. Within this site you will find general information about the district and the ad valorem property tax. welcome to. Property Tax Rate Llano County.

From pauliqnicoline.pages.dev

When Are Property Taxes Due In Ohio 2024 Jaimie Paulette Property Tax Rate Llano County this notice concerns the 2021 property tax rates for llano county. notice of 2019 tax year proposed property tax rate. updated property tax information now available for texas taxpayers; llano central appraisal district is a political subdivision of the state of texas that is responsible for appraising property for the. Within this site you will find. Property Tax Rate Llano County.